Banks have a reputation of being very traditional institutions. While older generations equated the word 'traditional' with dependability and trust, millennials equate it with tardiness and bumbledom. They're skeptical of the banks' ability to provide seamless services that fit their digital lifestyles.

Now, why is this an issue for banks and should they be worried?

Millenials are a generation that is quickly reaching full economic strength and maturing in terms of their social position and influence. In other words, they are a demographic with huge growth potential, but they also represent the biggest challenge for banks.

Let's take a quick look at some stats:

- According to the the Millennial Disruption Index, 71% of millennials prefer going to the dentist than going to their bank

- 33% believe they will not need a bank in 5 years

- Over 70% believe that the relationship with their bank is transactional only

This is just a hint at why millennials are so difficult for traditional financial institutions to market and sell to. Banks need a structural shift towards digital to better appeal to millennials, or they'll suffer significant losses in years to come.

How can banks win over the millennial generation?

Whether they like it or not, banks must begin acting more like big consumer brands. This means examining every aspect of their brand experience across channels (both online and offline) and finding ways to introduce more interaction, more personalization, and seamless omnichannel services.

It's all about matching their products and services to the behavioral patterns of the millennials, instead of expecting them to adjust their expectations. If their needs and expectations are not met, millennials will quickly change financial services provider with no regrets.

Younger generations want to minimize the time they spend managing their finances and banks have to find a way to provide their services on channels they use the most i.e. mobile and chat.

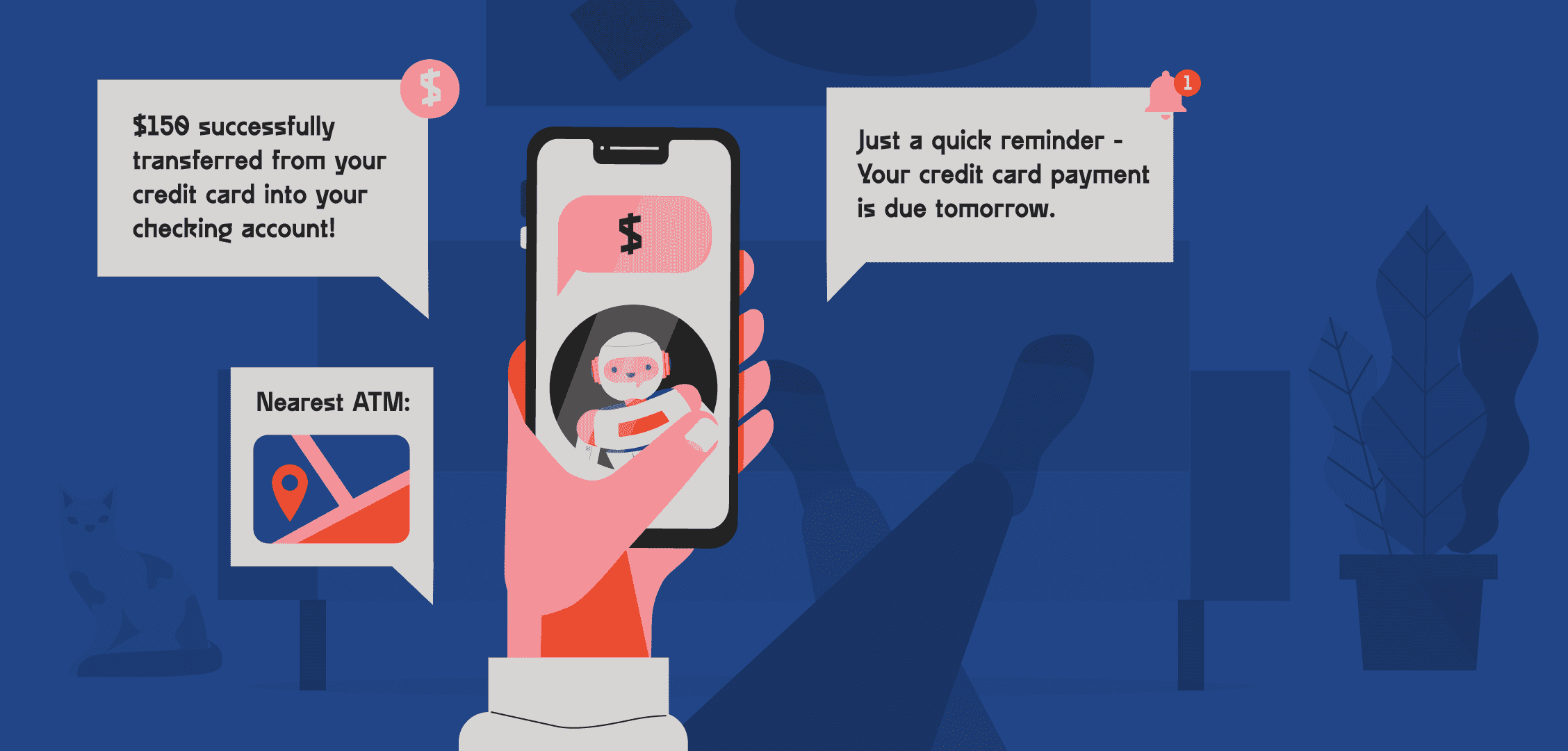

At the end of the day, it all comes down to convenient, instantaneous and straightforward interaction between the bank and their customers - and this is where chatbots come into play!

Millennial customers want:

- 24/7, on-demand customer service that does not involve phone calls or emails.

- Alternative money transfer and payment options on the channels they use the most i.e. mobile, messaging apps.

- Doing everything relating their financial life on mobile, including paying bills, checking balances, performing transactions, enquiring about financial products, etc.

- Authentic, personalized, and human touch in banking but through bank's digital functionality.

- Customized service and product recommendations related to their interests or to their current financial context.

Banks can achieve all of the above and more by leveraging intelligent banking chatbots.

Fully Digital Consumption

Banks now need to be literally everywhere or risk losing the interest of their younger customers and eventually their business. They need to engage millennials across channels, focusing heavily on Facebook Messenger, Telegram, and other popular messaging apps.

That's why they need intelligent chatbots that can provide authentic and user-friendly experience to millennial customers while enabling them to make transactions, manage their budget, and access all their financial information. It basically helps their customers to conduct financial business on their own terms, through a platform that enables pleasant, quick and straightforward interaction with instant results.

An AI-powered banking chatbot can track spending habits, share them with the customer and advise how they can save or invest. What is incredibly useful for banks is that they can gather data from all these interactions, learn more about their customers, and use these insights to improve their chatbot experience and tailor services by applying data analytics.

Another great opportunity for banks is leveraging machine learning and AI to predict their customers' banking needs. Predictive analytics in banking chatbots is the best way to anticipate and respond to the emerging needs of millennial customers.

Conclusion

Chatbots provide an effective channel for banks to secure the millennial and Gen Z customers by being present on the channels they use and love and by providing personalized service that gives the impression that their needs are being understood. A banking chatbot can converse with customers, learn from them, and respond to their needs - something that apps or any other tech before them couldn't deliver.

Learn more about how intelligent chatbots make banking feel human again.