This article was originally published in the Disruption Banking magazine, issue no 4 'Focus on AI.'

Banking, like every other industry, is feeling the pressure to adjust to the age of instant gratification. This need for immediate delivery and satisfaction is pushing out old systems and practices to replace them with new banking technology that can respond to the needs of perpetually impatient customers. But how fast is this happening?

It is difficult for such a traditional, heavily-regulated industry to move fast enough because it’s weighed down by years of legacy technology. We’ve seen this many times over working on digital transformation projects with banks in the region.

The demands that banks need to meet are tough - personalized, on-demand, context-aware services available on the digital platforms their customer base is already using. Websites couldn’t deliver this. Mobile banking just scratched the surface of things.

At SpiceFactory, we believe intelligent chatbots are the answer.

Continuous advances in AI technologies allow us to build chatbot solutions for banks that can seamlessly connect people to their products and services. Conversational and invisible interfaces are the future. Milos Zikic, CEO at SpiceFactory.

Not all chatbots are made equal

Banking chatbots built with AI technologies can understand the contextual request from a customer. They can be taught to ask and answer questions in a familiar, conversational language. This is something that digital interactions with banks are lacking - a more natural, intuitive user experience.

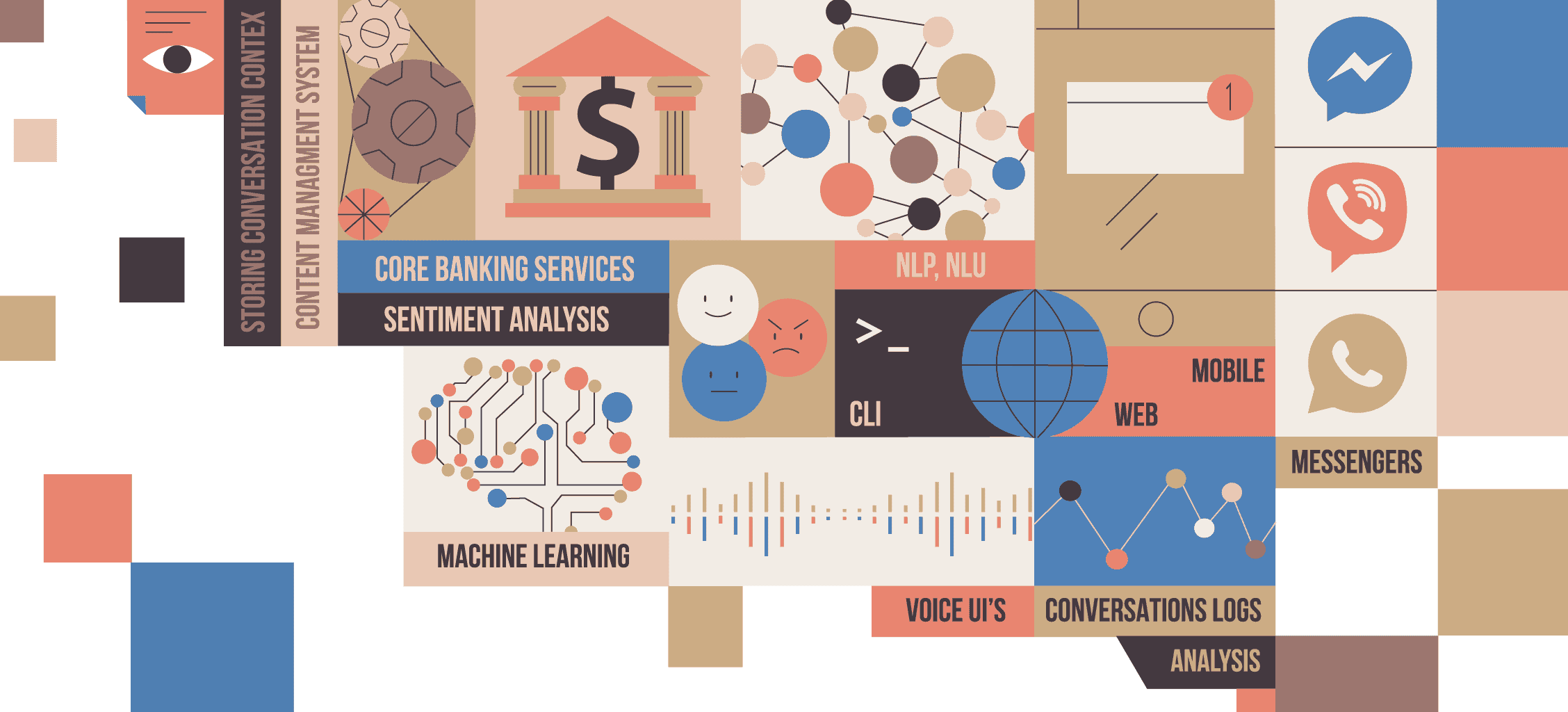

Our team recognized this early on and started to work on a solution. Leveraging technologies such as machine learning and natural language processing (NLP), we’ve built a chatbot that can learn from interaction with banking customers.

By connecting to internal banking systems (CRM, support software, etc.), it can proactively deliver relevant information in the context of customer activity. It works by interpreting the user's messages, analyzing them, and retrieving an answer from a database.

What separates an AI chatbot from a more basic bot?

- Machine learning - applied to automate analytical model building so that a chatbot can learn from data, identify patterns, and make decisions.

- The application of NLP to the understanding of human language - both in terms of syntax and semantics.

- Application of sentiment analysis which enables the chatbot to understand the emotion that the user is expressing.

An example of this is our banking chatbot Cognito that leverages all of the above. It’s a closed domain, retrieval-based solution that is smart enough to power all of the key use cases for banks including customer support, fraud detection, and personal finance advice.

However, the entire industry is still working towards ‘the dream.’ And the dream is a generative chatbot that doesn’t rely solely on the answers it can resurface from a database, but can potentially generate an unlimited number of answers for the user on the fly.

Natural Language Understanding (NLU) is important and smart conversation flows delight users. This is why we have a robust conversational builder at the core of our platform. The available in-house components allow us to enhance and adapt a conversation state machine for specific use cases, and to elevate messaging platform capabilities. Jovan Ercic, CTO at SpiceFactory.

According to Ercic, content understanding is the biggest technical challenge today. Knowledge base answers were not written in a way humans would speak to each other which prevents the chatbot to deliver human-like answers. He further adds that technology is still far away from being able to generate new answers by understanding existing materials from knowledge bases, FAQs, and websites.

Banking Becomes Conversational

Banks are beginning to understand that digital transformation doesn’t stop with the mobile app and online banking. If they want to remain competitive, banks need to innovate digitally and deliver uniquely personalized customer experiences.

Leading banks, such as Bank of America with it’s chatbot Erica, are already venturing into AI chatbot development projects in an effort to become “conversational” and move towards digital banking that is not only transactional but also relationship-based.

However, this is still in diapers and the solutions that are out there are simple chat interfaces inside proprietary mobile applications. These solutions don’t enable real conversational capabilities because it is much more efficient for the user to use the navigation buttons and the menu then to type.

What's even worse, these chat interfaces are missing the biggest chatbot benefit for the users - eliminating the need to download the application and instead message the bank via a messaging channel that they already use, like Facebook, Line, Viber, etc.

For banks, data privacy is a big concern and platforms that provide end-to-end encryption are better suited for exchanging information that contains user account data. Banks can choose to expose chatbots on Facebook Messenger (which is not encrypted but preferred by most users) that will handle only general information, like working hours, ATM locations, interest rates, etc., and point users to other communication channels for personal banking functionalities.

We cannot ignore that users today want efficiency and ease of use and this impacts every business. Users are spending their time in messaging apps and this channel should be used wherever applicable. Banking is a great fit because users need to perform quick actions without abandoning their current context. Our goal is to excel at conversational UX as it is much easier to lose a user in chat than through web and mobile UI. Milos Zikic, CEO of SpiceFactory.

Promising Use Cases of Banking Chatbots

Customer service. Chatbots are most commonly talked about in the context of customer service. They can act as an automation tool available to answer customer questions and resolve issues 24/7.

This capability dramatically reduces the cost of serving customers, but it also enables banks to provide personalized support and speed to resolution that digitally-savvy customers now demand.

Personal finance advice. Perhaps a more interesting case is a chatbot that provides personal finance advice by learning from interaction with customers. By tapping into core banking systems and analyzing customer’s card transactions, the chatbot can offer budget saving tips.

A customer may use this tool to check their account balance, see where they spent money in the past month, and ask for advice on how to best reach their savings goal.

Fraud prevention and detection. Fraud prevention is critical for banks because when fraud happens, customers lose trust in the bank’s security practices.

A banking chatbot can be programmed to monitor and recognize warning signs of fraud so it can instantly notify the affected customer, give them the option to verify suspicious transactions, and then suggest next steps for fraud resolution.

Personalized offers. Chatbots can deliver personalized product or service offers to customers based on their profile data or triggered by important life events. This means that it can deliver the right offer at the right time via the customer’s preferred communication channel which significantly improves conversation rates.

No matter the use case, banks are looking at chatbots as a way to simplify the overall banking experience for the users which ultimately delivers customer value both on the sales and the engagement side.

Conclusion

Looking at the current pace of implementation of conversational AI in banks, it is safe to say that digital banking will soon become more natural and more seamlessly integrated into customers’ lives.

With constant improvements and commoditization of algorithms behind AI and ML technology, chatbots will only become smarter. This will open up numerous opportunities for banks to facilitate more meaningful customer relationships and build brand differentiation, higher loyalty, and retention.